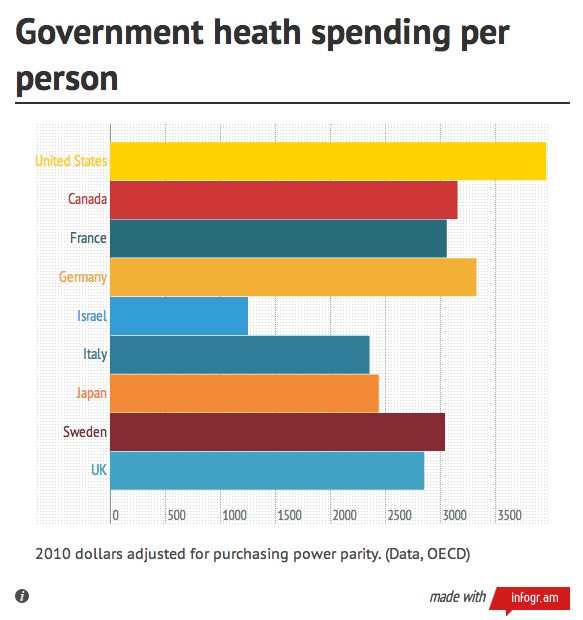

The chart below compares the cost of healthcare among a group of modern, industrialized nations. It should be noted that each of these other countries have all residents covered for their healthcare, while the U.S. does not.

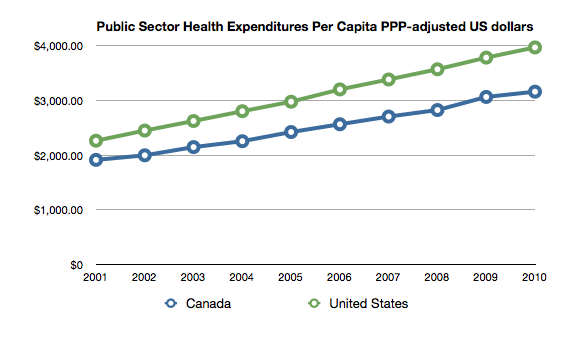

This next chart compares government healthcare spending per capita in the United States and Canada. Clearly while the United States spends more on healthcare, Canada covers healthcare for all residents, while the U.S. doesn’t.

And just what are we getting for all this money we spend on healthcare? What we get is that the United States of America rates #40 in life expectancy, behind Taiwan, Cuba, Costa Rica, etc.

Canada rates #11 in life expectancy, while Japan is #1, Italy is #5, France is #7, Sweden is #8, Israel is #9, Germany is #20, and the UK is #23. For further information on life expectancy around the world check out this Wikipedia page.

America actually spends more on private and government-provided health care than Canada, France, Germany, Israel, Italy, Japan, Sweden or the United Kingdom. In each and every one of those countries there is government-based systems that cover everybody — while we leave millions without healthcare coverage.

And, with all this extra spending on healthcare, life expectancy is higher in these nations than in our country. Where is all this extra spending going — the extra spending that is bankrupting our country? Why, it’s going to massive inefficiencies that Obamacare is intended to address, and to Insurance Companies, of course!

For an in-depth read on the subject check out Ezra Klein’s article at his WONKBLOG.

DYSFUNCTIONAL MUCH?

TO LEAVE A COMMENT PLEASE CLICK ON “COMMENT” BELOW TO LOG IN.