LOW TAXES HURTING THE ECONOMY?

A potential national debate on higher taxes vs. lower taxes may be brewing. Many concerned about the growing deficit and debt are warning that extending the Bush tax cuts will add more than $2 trillion to the federal budget deficits — which may give impetus to a review of the effectiveness of voo-doo economics, outside of wonky rightwing think tanks.

Is it possible that our economy is in terrible trouble because taxes are too low? Tax rates in our country are at a 60 year low, and many people think that the drastic tax cuts have done terrible damage to our economy.

Elliot Spitzer, former New York Governor, wrote an article in February for Slate magazine taking a look back at our economy over the last 80 years. He states, “During the period 1951-63, when marginal rates were at their peak — 91 percent or 92 percent — the American economy boomed, growing at an average annual rate of 3.71 percent. The fact that the marginal rates were what would today be viewed as essentially confiscatory did not cause economic cataclysm — just the opposite. And during the past seven years, during which we reduced the top marginal rate to 35 percent, average growth was a more meager 1.71 percent.”

And recently, Hillary Clinton spoke to the Brookings Institution and told them that “the rich are not paying their fair share in any nation that is facing (major) employment issues…whether it is individual, corporate, whatever the taxation forms are.” Greece is a case in point.

The Right would have you believe that Greece’s debt is caused by massive welfare policies. But, the Center for American Progress analyzed the current economic situation in Greece and concluded that “Greece has consistently spent less” than Europe’s other social democracies — most of which have avoided Greece’s plight. The real problem facing the Greeks is not how to reduce spending but how to increase revenue collections.” The conclusion is that the core of Greece’s economic problems is that it has relatively “anemic tax collections.”

Hillary Clinton told Brookings that some countries with high taxes and revenues are enjoying healthy economies. “Brazil has the highest tax-to-GDP rate in the Western hemisphere,” Clinton said. “And guess what? It’s growing like crazy. The rich are getting richer, but they are pulling people out of poverty.”

This is an issue that we here at CLN have been preaching about for months. The Reagan voo-doo economics theory has been bought ‘hook-line-and-sinker’ by many Americans, “lower taxes will lead to a healthy, growing economy, and high taxes (especially on the wealthy) will depress an economy.” Despite the historic FACTS to the contrary, the Right is just gonna keep-on-keepin’ on — doing that trickle-down voo-doo dance that they love so much.

There are some reasonable Republicans, among them is Greg Mankiw who was Chairman of the Council of Economic Advisers under W. He has expressed his view that the “across the board tax cuts” (which include the gigantic cuts for the mega wealthy) that is favored by so many on the Right do NOT pay for themselves in increased revenues for the federal budget — as the Right claims. “I did not find such a claim credible, based on the available evidence. I never have, and I still don’t.” He has called those on the Right that make those claims “charlatans and cranks.”

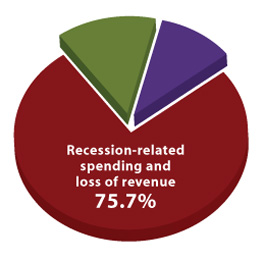

The fantasy theory of supply-side economics clearly did not work. The tax cutting that was championed under Reagan, Bush I, and W. resulted in rises in the ratios of debt to GDP. Under Reagan and Bush I the ratio of public debt to GDP rose from 33% to 64%. The ratio fell to 57% under Clinton, and rose again to 69% under Bush II. W’s tax cuts, wars, and economic crisis are responsible for almost all the economic woes projected for the next ten years.

Our economy is not in trouble because taxes are too high on the wealthy, nor because government safety-nets are in place. We agree with Clinton and Spitzer, and many other fiscal experts such as David Walker — who was U.S. Comptroller General during the Bush II terms, from 1998 – 2008, and is a former head of the Government Accountability Office (and a fiscal hawk) — said just yesterday, “Bush’s tax cuts for those earning $250,000 and more should be allowed to expire. That will raise about $400B over 10 years, not counting interest. From a practical stand point, that’s not going to undercut economic growth.” A sentiment expressed over the weekend by Treasury Secretary Tim Geitner.

The historic numbers give us the actual FACTS: higher marginal tax rates lead to growth because there are more resources available for job creation via public investment. In the 1950’s, under that Leftie Republican President Dwight David Eisenhower, the Interstate Highway System was built, connecting our country and creating jobs. It’s been estimated that in the first 40 years, the system was responsible for fully one quarter of American productivity. Every dollar spent on highway construction has returned $6. What Socialism! Public investment in infrastructure such as bridges, high-speed rail, roads, and broadband keep an economy strong.

Higher marginal tax rates also sustain the economy by creating incentives for capital investment. In other words, if marginal tax rates are high, businesses will be incented to plow their profits back into the business to take advantage of the tax write-offs for business investment, rather than paying higher taxes on profits. Thus growing the economy and creating jobs!

Secretary Clinton ended her speech telling the audience that this economic approach of higher taxes producing higher revenue, “used to work for us until we abandoned it.” Clinton told the assembled, “I’m not speaking for the (Obama) administration.” We sure wish that was not the case, because it’s way past time to have this discussion with the American people who have been bamboozled by the trickle-down fantasy for the past 30 years.

It’s time to put a wooden stake through the heart of this dangerous voo-doo practice that refuses to die.